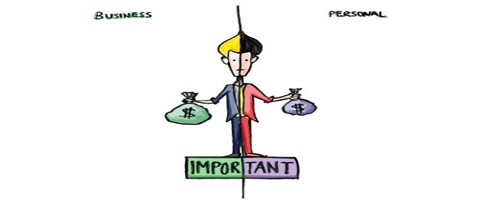

Business vs. Personal: Benefits of Separation

It is hard work starting up a company. The last thing you want to do is create

problems that turn into issues down the road! Many small business owners start

using their business account for personal expenses or vice versa. To fix this you

first need to separate business and personal accounts and the next step review

every transaction and correctly classify them. This can be time consuming,

however it is crucial for proper accounting.

Using your business income to pay for personal expenses you also violate the

“corporate veil” that protects you from the liabilities of the company. You may

ask what is this corporate veil? To put it layman’s terms, it basically means “a

legal concept that separates the business or corporation from each shareholders,

owners and partners, and protects them from being personally liable for the

company’s debts and any other obligations.” If you continue using your business

account for personal expenses, you are basically stating that there is no difference

between your business entity and you. If your company get sued, they can go

after your personal assets. No business owner wants that!!!

If you are a sole-proprietor or a single-member LLC you really can pay yourself

whatever amount you would like, and how often you would like from your small

business. Simply write a check from your business checking account to your

personal account, or transfer funds from your business account to your personal.

It is that easy. Just remember at the end of the year you will be liable for self-

employment taxes.

Contact Business by FR8 if this has happened to you, we can help get your books

in order because “Our business keeps you moving!”