Need Cash Fast? Considering the Factoring Company Option

Not all factoring companies are the same but here I will provide a generalization of factoring companies. You will need to read the details of the agreement with the factoring company to evaluate what their specific details and conditions are.

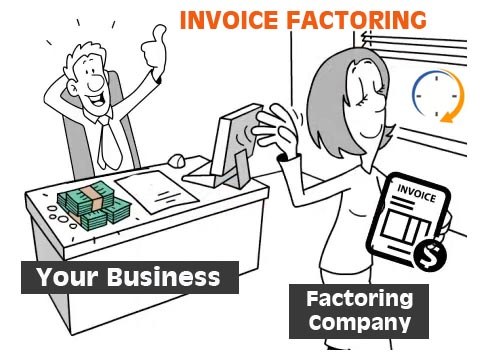

The design of a Factoring Company is that they will buy your unpaid customer invoices from you for a percentage and give you the remaining balance. As a rule, most will pay an automatic ACH payment in 24-48 hours. And some even offer an instant payment by wire for an additional fee. Then, the customer will have approximately 60 days to pay the invoice to the factoring company. For small businesses this can be a good way to ensure quick and steady cash flow into your business, but there can be a few downsides to this arrangement.

Getting Approved: You must be considered credit worthy. If you have decent credit this will probably not be an issue. However, just like with a bank loan, some factoring companies can be more selective than others and some may require more information than others. Debt to income ratios, revenues, and history of bill payment as well as other factors will all play in the final decision.

Read All the Fine Print: Factoring company agreements can vary. Make sure that you are aware of all the fees and conditions that apply.

-

-

- Factoring Fees – Generally, factoring fees are between 3% to 5% of the amount of the invoice.

- Wire Fees – If a factoring company wires your payment to you there may be an additional fee.

- Non-payment – A fee can apply if the customer does not pay the invoice to the factoring company in the given term. Most terms are 60 days.

- Contract Period – Some factoring companies do not require a factoring contract term, but some do. Be sure that the period of the term is agreeable for your operation.

-

Getting 24-48 hour Pay: Majority of the factoring companies do offer 24-48 hour turnaround time for pay, however, that clock counter does not begin at the point of submission of the invoice and supporting documents, but at the point when the documents are accepted. This means that if there is an issue with any of the documents, it can be rejected until the issue is corrected. Additionally, your documents must be submitted before their cut-off time. For example, if it is Friday and the cut-off time is 11:00 am. You get your documents submitted just in time at 10:55 am. However, when you check back to see the payment has been processed a short time later, it shows that there were issues with some of the documents. Their daily cut-off has now passed. You can correct the issues and resubmit it, however, unless your request for a wired payment (for an additional fee), you will not receive the payment until Monday.

Factoring Approval: In the transportation industry, reputation is key. You have broker ratings and the shipper/receiver’s ratings. For a factoring company, the ratings can be very important because they are who will be paying the bill. In addition, factoring companies have their own rating system and some customers may not be acceptable for factoring because of their rating. Usually this means that they have purchased invoices for the customer before and they were not paid on time or there were some issues involving payment. In this case, you will need to bill the customer directly.

Your Continued Involvement is Necessary: The arrangement has been made between you and your factoring company but that doesn’t mean that you can just leave the Accounts Receivable work in their hands. You need to be sure that the process has completed from beginning to end. Because you and your business will be responsible for each transaction in your accounting system. This will be especially important at tax time.

- Create a load logging system of each load and include all the details of the load. Include all important details to track – When you have received payment and when the payment from the customer is due to the factoring company.

- When payment is received from the factoring company, document what was the factoring fee held on the load and what amount you were actually paid and on what date.

- Check back with the factoring company that the customer has paid them for the invoice. This is important because ultimately, if they do not pay the factoring company when payment is due, you will be responsible to pay the money back to the factoring company. It is not until the customer has paid back the factoring company for the factored invoice that the Account receivable process is complete.

While the use of a factoring company can be extremely helpful in keeping a steady stream of cash flow in your business, it also reduces your profits. If you feel the need to use a factoring company, try to only use it temporarily and have an exit plan in mind. Depending on your customer, they may offer a quick-pay option. A fee will still apply when using quick pay, but it is less than if it is factored.

Regardless of choosing to use a factoring company or not, ensuring your business maintains a constant cash flow is a vital function of your business and it is what keeps your business operating. At FR8 Solutions, our business is designed to support all types of Accounts Receivables. If you have discovered that managing the many tasks of your Accounts Receivables is too overwhelming, we can help. Call us today to see how we can ensure that you have consistent cash flow into your business to keep your business running smoothly.